Government Paid Maternity Benefit

Supports eligible working mothers (including self-employed mothers) who do not qualify for the Government-Paid Maternity Leave scheme due to their employment arrangements (e.g. on short-term employment contracts, or employment contracts had expired before the birth of their child).

You must have been employed for a total of at least 90 days in the 12 months before you give birth. If you have been employed at various places and/or self-employed over the course of 12 months before giving birth, the total duration of employment periods should add up to meet the 90-day minimum employment criteria.

The eligible Maternity Benefit is equivalent to the Government-paid portion of the Government-Paid Maternity Leave (equivalent to eight weeks for the first and second child orders, and 16 weeks for the third and subsequent child orders).

The amount of Maternity Benefit you will receive is based on the gross rate of pay and employer CPF contributions, and the net trade income earned in the 12 months preceding the delivery. This is computed by dividing the total monthly gross rate of pay in the 12 months over 365 days. You should apply for the Government-Paid Maternity Benefit within 15 months of your child's birth.

You are eligible if you meet all the following criteria:

- Your child is a Singapore Citizen. If your child is not a Singapore Citizen at birth, you can be eligible for Government-Paid Maternity Benefit if your child obtains Singapore Citizenship within 12 months from his or her date of birth.

- You have been in employment or self-employed for a total of at least 90 days in the 12 months before the birth of your child.

Click here for more details on the application process.

-

FAQ

-

1. Can I claim Government-Paid Maternity Benefit and enjoy Government-Paid Maternity Leave at the same time?

No. If you qualify for Government-Paid Maternity Leave, you will not be able to claim the Government-Paid Maternity Benefit, except if:

- You are on no-pay leave (at your request) for a continuous period ending at least 12 months after the child's date of birth; or

- You qualify for maternity leave under the Employment Act and your child becomes a Singapore Citizen before 1 November 2021; or

- Your employment had been terminated:

- Upon completion of your contract or service; or

- Upon retrenchment

-

2. How do I apply for Government-Paid Maternity Benefit?

Click here for more details on the application process

-

3. How is the amount of Government-Paid Maternity Benefit determined?

It is determined based on the Government-Paid portion of maternity leave (i.e. eight weeks for the first and second child order; 16 weeks for the third and each subsequent child orders, pro-rated by the mother’s employment period in the 12 months preceding childbirth).

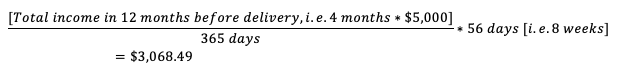

The amount of Government-Paid Maternity Benefit is calculated based on the total income earned in the 12 months before childbirth, divided over 365 days to obtain a daily rate. Net trade income from self-employment can also be included when calculating the total income that attracts Government-Paid Maternity Benefit payment.

For example, if a mother worked for four months at a rate of $5,000 per month (including employer CPF contributions) in the 12 months (or 365 days) preceding delivery, and gives birth to her first child (i.e. eight weeks or 56 days), her Government-Paid Maternity Benefit will be:

-

4. What can be included as income for Government-Paid Maternity Benefit computations?

For employees, the gross rate of pay stated in the contract of service over the 12 months preceding the birth of the child can be included for Government-Paid Maternity Benefit computations. It includes employer CPF contributions but excludes overtime payments, bonuses/annual wage supplements, reimbursement of expenses, productive incentive payments (i.e. variable payments to reward improved performance/increased productivity/increased contribution to the business).

Allowances that can be included have to fulfil the criteria below:

- Earned under your contract of service in the 12 months immediately before your child's date of birth;

- Paid on a regular basis;

- Attracts Central Provident Fund contributions (where applicable); and

- Not any of the following:

- Overtime payment;

- Bonus payments or annual wage supplements;

- Reimbursement for expenses incurred;

- Productivity incentive payments; or

- Travelling (transport), food or housing allowances.

For the self-employed, the trade income (stated in the Notice of Assessment), over the 12 months preceding the birth can be used for Government-Paid Maternity Benefit computations.Both trade income and income earned under the contract of service can be combined for Government-Paid Maternity Benefit computations.

-

5. How are the 90 days of service in the 12 months before delivery calculated?

If you are on a term contract, the tenure of the contract (inclusive of the start date, end date, weekends and public holiday) would be used to compute the period of service. Employment duration under different terms can be totalled.

For daily-rated employees, the duration employed would be computed based on the actual number of days worked.

For those who worked for multiple employers within the same period of time, the “overlapping” period would only be counted “once” (using both salaries) in computing the length of service. Both salaries will be used in the computation to reflect the total income earned in the 12 months period.

-

6. Why do I only get eight weeks' worth of Government-Paid Maternity Benefit for my first and second child order, and 16 weeks for my third and subsequent child order?

The Government-Paid Maternity Benefit is based on the Government-Paid portion of Maternity Leave, i.e. eight weeks for the first and second child orders, and 16 weeks for the third and subsequent child orders.

-

.tmb-small.png?Culture=en&sfvrsn=bb85edfb_1)